Real-time

for municipal market participants.

Munichain simplifies municipal bond formation with a centralized platform that seamlessly integrates into existing workflows, enhancing communication and streamlining collaboration throughout the new issue lifecycle. Welcome to the definitive source of truth for every member of the working group.

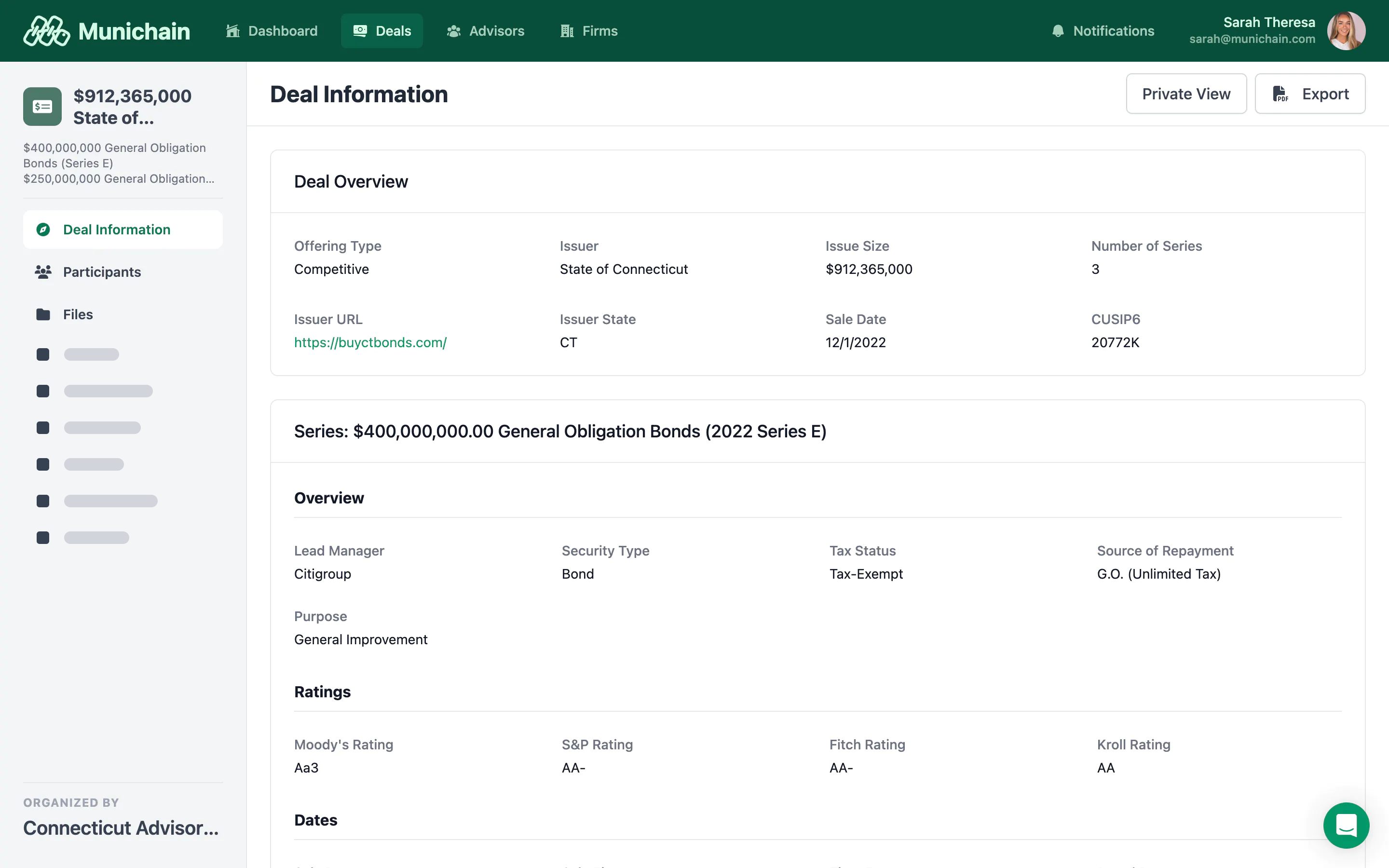

Deal Management

Organize and lead through the new issue process.

Track and share deal-related matters across the working group throughout the new issue life cycle.

- System of Record

- Centralize the data that's typically spread across numerous systems — now in one place for storage, review, and analysis.

- Unlimited Participants

- Invite both internal and external deal participants to contribute in a permissioned environment — all at no extra cost.

- Exportable Reports

- Easily share data across the working group, or export the deal and share with outside parties.

Collaboration and Communication

Align the working group with the latest information.

Announce updates, share agendas, and discuss changes with any participant in the working group.

- Communicate Internally and Externally

- Set up topics to communicate the right information to the right participants at the right time. Manage all communication in one central location.

- Notifications for Muni Professionals

- Break free from email clutter. Receive customized alerts in-app and a daily summary directly to your inbox.

- Create and Share an Agenda

- Build and publish an agenda to the working group outlining key tasks, events, and dates during the new issue process. No more “reply all” emails to handle a minor schedule change.

Sarah added a new post in the topic: General

Matthew updated the agenda item Circulate Near Final POS and POC

Michael has set USD No 479 Anderson County KS (OS).pdf as a public document

Matthew updated the agenda item BOE Considers and Approves Resolutions

Sarah updated the agenda item Annual Filing

Bob updated the Performance section of the deal

Michael updated the agenda item Request Quotes for Bond Insurance

Sarah updated the series 2025B: Revenue Bonds (Tax-Exempt)

Matthew added a new post in the topic: General

Michael updated the agenda item Circulate Near Final POS and POC

Bob has set USD No 479 Anderson County KS (OS).pdf as a public document

Matthew updated the agenda item BOE Considers and Approves Resolutions

Michael updated the agenda item Annual Filing

Sarah updated the Cost of Issuance section of the deal

Matthew updated the agenda item Request Quotes for Bond Insurance

Bob updated the series 2025B: Revenue Bonds (Tax-Exempt)

Customer Relationship Management

Nurture your muni relationships.

Maintain and grow your client relationships throughout the deal lifecycle with a full-featured CRM suited for municipal finance.

- Build a Pipeline

- Prepare for future opportunities with integrated deal tracking and pipeline organization.

- Track Communications

- Log all communications with clients and prospects in one place for easy reference and follow-up.

- Manage Contacts

- Keep track of all your contacts and their interactions with your team. Easily connect contacts with prospective deals for a full view of your relationship.

| Communication | Point of Contact | Outreach Method |

|---|---|---|

4/7/2024 | Michael | Phone |

5/20/2024 | Matthew | |

6/15/2024 | Sarah | Phone |

6/25/2024 | Heather | |

7/10/2024 | Matthew | Phone |

Analytics, Insights, and More

Keep tabs on your team's activity and revenue.

Manage your team and track progress across multiple deals with actionable insights and updates.

- Manage Teams and Members

- Assign members to teams and track team performance.

- Track Deals At Every Stage

- See which deals each team is running, the status of those deals, and historical performance.

- History, Archives, and Remote Guidance

- Rest assured that full deal archives are stored and retreivable in case you need it. Track your team's changes as they happen, or request a full history report at any point in the future.

Revenue (YTD)

$1,475,000

Completed Deals (YTD)

10

Want to learn more? Check out the links below or request a demo to get started.

Portland Issues $154 Million in Water Bonds

Seattle Museum Authority Issues $18 Million in Bonds

San Diego School District Sells $200 Mln in Notes

Join the next evolution of public finance.

Get started with streamlined workflow solutions that make the new issuance process more collaborative, organized, and efficient.